Access to the latest Korean startup news and startup database for free

#Weekly Funding Overview

[Oct. 25~ Oct. 29]The total funds raised by Korean startups of this week is KRW 103.1 billion.

| Company | Inudustry | Amount | Round | Investors |

|---|---|---|---|---|

| Padobox | Ecommerce | - | Pre-SeriesA | Jeju CCEI |

| Jinjicompany · | Sideproject platform | - | GRANT | TIPS |

| Meatartisan | Agriculture | - | M&A | Green Labs |

| Korea Senior Lab | Silver care | 11 billion | Series A | Softbank Ventures, Hashed, Guardian Fund, Springcamp |

| Wants | 4 billion | Series A | KOREA ASSET INVESTMENT SECURTIES, Gamechanger Investment | |

| INOGENIX | Bio/Healthcare | - | Seed | Crypton |

| Matei | Hotel solution | - | Series A | NH Investment & Securities, Foodn, Ascendo Ventures |

| EST Mob | File Sharing | - | M&A | Rakuten |

| Lemon tree | Fintech | 5 billion | Seed | KB Investment, Spring Camp, Capstone Partners, TBT Partners, Bass Investment, Fast Ventures, D.CAMP |

| PLASK | Content | 3 billion | Pre-SeriesA | Smilegate Investment, KT Investment, Timewise Investment, NaverD2SF |

| Exosystems | Bio/Healthcare | 4.5 billion | SeriesA | SBI Investment, Laguna Investment, KIBO |

| Tripbtoz | Travel | 3 billion | Pre-Series B | SJ Investment Partners, TS Investment, NICE Investment Partners |

| Bunnit | Healthcare | - | Seed | DHP, Block Crafters, Strong Ventures |

| Changupin | AI | - | Pre-SeriesA | Gyeongg CCEI, Daedeok Venture Partners |

| TEUIDA | Education | - | GRANT | TIPS |

| Movv | Mobility | 4 billion | Atinum Investment, K2 Investment, Seoul Techno Holdings | |

| Vrism | Metaverse | 3 billion | Series A | Hashed |

| Brownbagcoffee | Coffee subscription | 3 billion | Pre-Series A | Medici Investment |

| Exostemtech | Bio/Healthcare | 10 billion | Series B | DSC Investment, IMM Investment, WeVentures, Laguna Investment, Hana |

| Vart | ART | 500 million | Seed | SOLAIRE Partners |

| Hobbyful | Hobby Kit | 4.1 billion | Series A | HB Investment, Laguna Investment, Behigh Investment |

| Humeals | Food | - | Seed | Series Ventures |

| Cluemetic | Cosmetic | - | Seed | Block crafters |

| Havest | Bio/Healthcare | - | Seed | Seoul Techno Holdings |

| Jiguin Company | Cultured meat | 28 billion | IMM Investment, Invisioning Partners, KDB, Stic Ventures, Premier Partners, Crit Ventures, Primer Sazze Partners | |

| Thesatellitebrewing | Craft Beer | 4 billion | Series A2 | Magellan Technology Investment, T Investment, Dasan Ventures |

| Pillyze | Bio/Healthcare | 3 billion | Seed | Milestone Venture Partners, Primer, Strong Ventures, Fast Ventures, Next trans |

| LN Robotics | Bio/Healthcare | 8 billion | Series A | Mirae Asset Venture Investment, Mirae Asset Capital, Stic Ventures, Bluepoint Partners, Hanwha Investment & Securities |

| Dob Studio | Content | 5 billion | Pre-SeriesA | Timewise Investment, NauIB Capital, T Investment, Dexter Studios |

| AMR Laps | Logistics | - | Seed | CNTTECH |

Major Funding

- Jiguin Company, secured a 28 billion won investment. After launching a meat alternative named Unlimeat, the company provides Unlimeat products to CU convenience stores and Domino’s Pizza and expands its business globally. It aims to establish a clean meat factory dedicated exclusively to alternative meat production and to operate it in the first half of 2022.

- Silver Tech Start-up Korea Senior Lab drew an investment of 11 billion won. With the goal of digital transformation of the nursing care industry, it operates a SaaS for automating manual administrative tasks at nursing centers and a job alert service for nursing care workers.

- Children’s fintech startup Lemontree raised a 5 billion won investment. The company is working on an app service where parents can manage their children’s allowance, financial education, and stock investment all at once.

- Hobbyful, an online hobby platform, secured an investment of 4.1 billion won. With this funding, the team plans to expand its hobby kit sales business in cooperation with creators, brands, and IPs.

- 3D digital fashion metaverse platform Vrism raised 3 billion won. It develops technology that can reproduce the shape and texture of items and provides various XR technology to Nike and other brands. The company is preparing for the NFT market and aims to enter the fashion metaverse beyond online shopping.

#Trend Analysis

Japan’s Startup Ecosystem is Growing

Softbank is considered to be a big player in the global venture capital market. Startups in which Softbank invested are highly regarded for their potential to succeed in the global market. Coupang is a case in point. Although it is a country with big shots in investment, it is hard to feel the enthusiasm for startups in Japan. There is no unicorn company that everyone knows. Some say that Japan’s unique culture, which is closed and values traditional industries, is blocking the growth of innovative startups.

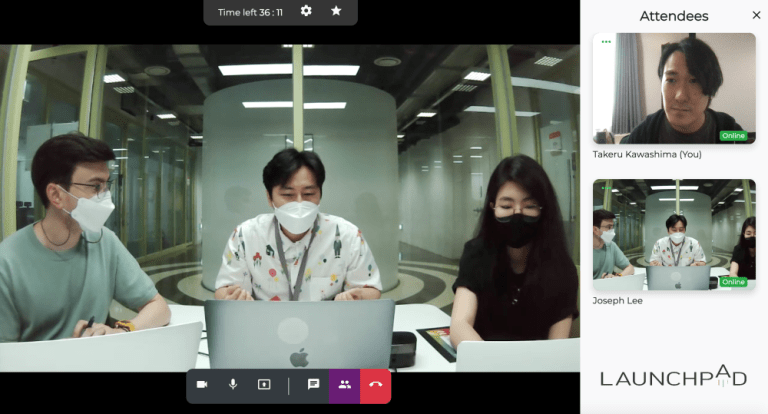

It’s been a while since this ecosystem has changed. Takeru Kawashima, 01 booster director, said, “From around 2017, a startup ecosystem began to form little by little, but there was not much I could say before.”

Founded in 2012 and fostering early startups, 01 booster has made COVID-19 an opportunity to expand its global partners. This is why the team signed a business agreement with KOCCA and participated in Launchpad, the program to support content startups’ global expansion. It plans to take this opportunity to discuss investment in Korean startups in earnest and support corporate connections through local networks in Japan. It has recently completed the selection of the 10 final launchpad teams that will try to break into the Japanese market.

“Metaverse & KPOP startups are interesting”

With COVID-19 this year, the metaverse is now the most up-and-coming field in the world, popular in Japan as well. Director Kawashima selected Art & Space IT, a metaverse startup, as the most interesting company among the launchpad teams. It provides services for fans, such as reenacting the space shown in K-POP music videos under the slogan of small digital twins. He also thought the Lighters Company, which provides an online live platform, has a chance of success in the Japanese market. “Metaverse is a promising field, but it is difficult to find related companies,” said the director. “Korea is strong in this field because it has a history of MMORPG games, an early version of Metaverse.”

Another strength of Korean startups that he mentioned is a global mindset. He said, “Japanese startups are growing in the domestic market and aiming for an IPO, but it is impressive that Korean startups are targeting the global market from the very early stage,” he said. “This is a rare phenomenon in Japan.”

Large CVCs are the big investors.= According to Director Kawashima, in the ecosystem of Japanese startup investment, large companies play much larger roles than the government, unlike Korea. He said, “One of the biggest characteristics of the Japanese startup ecosystem is that companies take a huge part in the investment,” adding “40% of the 01 Booster funds come from large companies.”

There are also more Corporate Venture Capitals than in other countries. The 01 Booster also plans to connect Korean content startups with large companies and help them settle in the Japanese market. “There are many rumors that it is difficult for global companies to enter and run the business in Japan,” he said. “I agree to some extent, but it is also difficult for Japanese companies to do business in domestic demand.” Instead, the Japanese market is very large, and there are many opportunities, especially in the B2B market. Director Kawashima said, “Recently, interest in Korean startups has grown with the drama Startup, and thanks to K-pop, people have a high understanding of Korean culture,” and advised, “Try advancing into the Japanese market.”

![[StartupRecipe] South Korea’s Startup Investment Landscape 2025: 10 Key Findings](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260208_One-page-briefing_ai_00002-200x140.jpg)

![[StartupRecipe] Physical AI Tops Korean VC Investor Preferences in 2026](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260129_Startuprecipe-Investment-Report-_00001-200x140.jpg)

![[StartupRecipe] How Korea’s 10 Early-Stage Investors Performed in 2025](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260120_car-racing-desert_ai_5002305-200x140.jpg)

![[StartupRecipe] 85% of Korean Students Use AI, Few Know AI Startups](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260118_seoul_ai_00305035523-1-200x140.jpg)

![[StartupRecipe] Korea’s scale-ups are ditching Seoul and here’s why](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260107_deep-tech_ai_00000006-200x140.jpg)

![[StartupRecipe] The Rise of U.S.-Based Korean Startups](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/251229_Aerial-drone-photography_ai_00001-200x140.jpg)