Local giants grab top spots in Kantar’s ad equity measure

SINGAPORE, Oct. 3, 2023 /PRNewswire/ — Kantar reveals Google has taken the title of consumers’ most preferred ad platform in Asia Pacific, retaining its first position clinched last year. According to Kantar Media Reactions 2023, most consumers consider ads on Google to be relevant and useful, with few viewing them negatively. Google is the second favourite platform for marketers in APAC. Among marketers, YouTube leads the top of the charts, demonstrating that perhaps for now marketers prefer established media brands, even if they do not register in consumers’ top preferences.

Kantar Media Reactions 2023 report uncovers the attitudes of consumers and marketers to ad platforms and channels. The annual study, now in its fourth year, is based on interviews with 16,000 consumers in 23 markets and 900 senior marketers globally.

Top-ranking global media brands in Asia Pacific

|

Consumers APAC |

Marketers APAC |

||

|

1 |

Google (-) |

1 |

YouTube (-) |

|

2 |

Instagram (+1) |

2 |

Google (-) |

|

3 |

TikTok (+4) |

3 |

Instagram (-2) |

|

4 |

Amazon (+2) |

4 |

TikTok (-) |

|

5 |

Spotify (-3) |

5 |

Amazon (+2) |

Note: (-) refers to rank being unchanged versus 2022

Google remains the most popular ad environment among consumers second year in a row. Instagram rose to position 2 this year, boosted by Australia and Indonesia where it was the top media brand platform. TikTok, the most endorsed for Fun and Entertaining Ads has helped it to secure the third rank with a +4 higher ad equity score in 2023. E-commerce giant Amazon takes 4th spot in APAC, while it is the most preferred ad platform in the global ranking. Spotify, the top and perhaps only audio streaming brand also known for its High-Quality ads secured its spot in the top 5.

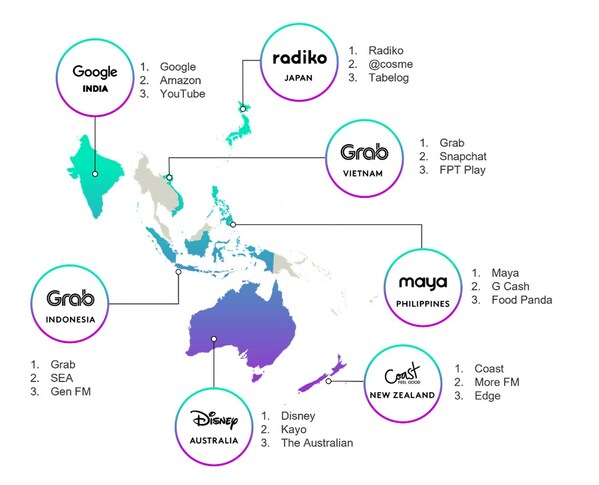

Taking local brands into consideration, most markets have local brands in the Top Spot

Interestingly, Google is the sole global brand which Kantar measured that claimed the top spot in a country, by being ranked at the top in India. In all other APAC markets, local brands took the top honours. An exception would be the super app Grab, a regional Southeast Asian giant that came up top in both Vietnam and Indonesia.

Grab has been a relatively new player into the retail media network space, yet proving to have strong potential for advertisers to explore as its ad placements are seen to be less intrusive. Advertising today that consumers are more receptive to, seems to seamlessly integrates into consumers’ lives; in their scrolling, viewing or simply while they go about their days.

Top-ranking media channels in Asia Pacific

|

Consumers APAC |

Marketers APAC |

||

|

1 |

Sponsored events (-) |

1 |

Online video (-) |

|

2 |

Out of home (+2) |

2 |

Digital out of home (+5) |

|

3 |

Magazines (+3) |

3 |

Video streaming (-) |

|

4 |

Cinema / Digital out of home (-1) / (+1) |

4 |

Sponsored events (+6) |

|

5 |

Point of sale (-3) |

5 |

Out of home (+6) |

Note: (-) refers to rank being unchanged versus 2022

This year’s analysis reveals that “in-person” touchpoints dominate consumers’ preferred channels – with Sponsored Events taking the lead. The rest of the top five also comprises channels that are experienced in-person, including out-of-home, magazines, cinema ads, digital out-of-home and point of sale.

According to the research, new media channels are more appealing to marketers than to consumers, who favour less intrusive options. Podcasts are the most popular online media channel, and with Spotify taking a top spot in the global media brand consumer ranking, it is important for marketers to review its’ potential to connect with consumers in a unique way.

On the other hand, TV, which used to be a staple of advertising campaigns, is missing from the top choices of marketers this year. Consumers have never rated TV highly, but marketers used to value it more. Only 7% of marketers plan to increase TV spending in 2024. Music streaming, online video and video streaming are the media channels that marketers expect to invest more in 2024.

Kartikeya Varma, Head of Media APAC, Kantar, said: “We know advertising campaigns are seven times as impactful among receptive audiences, so for marketers it is essential to know how different ad platforms perform and how receptive the audiences are, to allocate their budget wisely and create effective campaigns. Out-of-home advertising, such as sponsored events or cinema ads, is the preferred choice of consumers in Asia Pacific. And influencer content is queen in terms of capturing and delivering attention, amongst both consumers and marketers.

However, Asia Pacific is a diverse region with varying preferences and behaviours across markets and categories, so advertisers need to tailor their strategies accordingly to reach audiences with impact in a consistent manner. An over-whelming majority of marketers tell us they will increase their spending on video content in 2024. At the same time, we advise marketers not to overlook the potential of in-person media channels, which can offer high levels of consumer receptivity and attention. With the right content and customisation, these channels can enhance the brand impact of ad campaigns”.

Download a copy of the Media Reactions 2023 study and register to watch the webinar “Kantar Media Reactions in APAC 2023”.

About Kantar – Kantar is the world’s leading marketing data and analytics business and an indispensable brand partner to the world’s top companies. We combine the most meaningful attitudinal and behavioural data with deep expertise and advanced analytics to uncover how people think and act. We help clients understand what has happened and why and how to shape the marketing strategies that shape their future. For more information, please get in touch with ellen.cuijpers@kantar.com

About Media Reactions 2023 – Kantar has been researching media experiences and perceptions for over 20 years. Media Reactions combines consumer and marketer studies for a complete view of the current media landscape and how to navigate it. The 2023 survey spoke to around 900 marketing professionals from advertiser, agency and media companies around the world. The consumer survey is based on around 16,000 interviews in 23 markets (Argentina, Australia, Belgium, Brazil, China, Colombia, Egypt, Germany, Greece, India, Indonesia, Japan, KSA, Mexico, Netherlands, New Zealand, Philippines, South Africa, Taiwan, UAE, UK, USA, and Vietnam).