Access to the latest Korean startup news and startup database for free

#Weekly Funding Overview

[Jan. 18~ Jan. 22]The total funds raised by Korean startups of this week is KRW 73.8 billion.

| Company | Inudustry | Amount | Round | Investors |

|---|---|---|---|---|

| Helpspeaking | - | Seed | Sopoong Ventures | |

| Gotcha | Mobility | 350 million | Seed | Series Ventures, GyeongnamCCEI |

| Cellmeat | Food | 5 billion | Pre-Series A | BNK Securities, DT&Investment, RYUKYUNG PSG, GAIA Venture Partners, JNU Holdings, Yonsei Technology Holdings, Knollwood Investment Advisory, Strong Ventures, Primersazze, Primer |

| PSX | Fintech | 1 billion | Softbank Ventures | |

| Binary Bridge | Logistics | - | Seed | Fast Ventures |

| Red Rocket | P2P | 1.5 billion | Pre-Series A | Springcamp, Knollwood Investment Advisory, Strong Ventures |

| Onulhoi | Food | 12 billion | Hana Ventures, KT Investment, GA, Korea Investment Partners, Korea growth investment, Mirae Asset Venture Investment, Mirae Asset Capital, KTB Network, Daesung Venture Capital | |

| Datahunt | AI | 2.2 billion | Fiscalnote | |

| Dift | - | Pre-Series A | Awesome Ventures | |

| Atsens | healthcare | 8.5 billion | Series A | Hana Financial Investment, DS Asset Management,Vision Creator, INTOPS INVESTMENT, Samho Green Investment, Sneak Peek Investments, APS Korea |

| Wellfish | Food | 100 million | Seed | MYSC, Gyungnam CCEI |

| Autocrypt | Mobility | 14 billion | Series A | KOREA ASSET INVESTMENT SECURITIES, Industrial bank of Korea,HYUNDAI VENTURE INVESTMENT, KB Investment, Pathfinder H, Ulmus Investment, |

| Softberry | Mobility | - | Pre-Series A | SKRENTCAR, Hyundai motors zero1 |

| Tanker | Prophtech | - | Mirae Asset Venture Investment, Industrial bank of Korea, CNTTech, Korea Social Investment | |

| MGRV | Co-living | 15 billion | KB Investment, HB Investment,TS Investment, We Ventures, Seoul Investment Partners, Daesung Venture Capital, UBIQUOSS Investment, Mega Investment | |

| Howbuild | construction | 13 billion | Series B | Softbank Ventures, SK D&D, Lighthouse Combined Investment, Hana Ventures, Murex Partners |

| Doinglab | Healthcare | 1.5 billion | Insight Equity Partners |

Major Funding

- Impact developer MGRV, which runs the co-living brand Mangrove, has raised KRW 15 billion Series B funding which makes the total funding amount at KRW 20 billion. MGRV provides a reasonable residential solution for single person households in the city. With the new funding, MGRV plans to open the second co-living space that can accommodate more than 400 people by June.

- Autocrypt, an automobile security company, has attracted an investment of KRW 14 billion in Series A investments. Autocrypt provides a total vehicle security solution across the entire transportation environment, including vehicles, transportation infrastructure, and mobility services.

- HowBuild, a construction platform, has secured KRW 13 billion in a Series B funding. HowBuild provides a service that connects architects and construction companies by bidding so that even individual owners with relatively low architectural knowledge and individual architects can easily and competitively proceed with construction.

- Onul-Hoi, a fisheries platform, secured KRW 12 billion in funding. With the new funding, the company upgrades its one-stop service that will unite the fisheries ecosystem from fisheries production to distribution.

More Funding

- Data Hunt, an AI-based data collection/processing company, attracted KRW 2.2 billion worth of investment from global software company FiscalNote and plans to target overseas markets.

- PSX, which operates the unlisted stock trading platform “Seoul Exchange Unlisted,” attracted KRW 1 billion in seed investments to record KRW 3.5 billion in cumulative investments.

- Redrocket, which runs a campus fund specializing in credit loans for college students, attracted KRW 1.5 billion worth of investments in Pre-Series A. They plan to secure manpower and expand its customer base.

Undisclosed Funding

- Softberry, which operates EV Infrastructure, is an eco-friendly electric vehicle charging service platform. They attracted Pre-Series A investments.

#Trend Analysis

5 Korean startups could be next unicorns

The number of unicorn startups is steadily growing in Korea and has now hit 13. In Korea, the government made considerable efforts to the birth of unicorns with financial subsidiaries. As many domestic investors expected to see more unicorns this year, here are 5 Korean startups expected to be the next unicorns.

Healing paper, a provider of Gangnam Unni, is a mobile healthcare and information technology company. Founded by the two doctors in 2015, the medical beauty app Ganganm Unni provides a community for those who seek information about plastic surgery. Users share their experience on the platform to help others to make a better decision on choosing the right hospitals and recovery care after plastic surgery. The company raised KRW 18.5 billion in a series B funding round led by legend capital last year and acquired Japanese second largest beauty app called Lucmo to expand its business into Japan. As of 2021 Jan, one out of three plastic surgery hospitals in Korea uses Gangnam Unni and has more than 260 million users.

Sandbox network is Korea’s leading MCN company that works with various creators and streamers to produce digital entertainment contents on topics ranging from music, game, kids, mukbang to various hobbies. Founded by game Youtuber ‘Dotty’ who has 2.44M subscribers and a former Googler in 2015, the company became the most renowned MCN company in Korea. Currently Sandbox manages and represents more than 360 creators, generating over 2.3 billion average monthly views. Sandbox offers marketing solutions for businesses based on creators’ IP and content. Sandbox’ s business areas are diverse, ranging from commerce to e-sports.

Backpackr provides an online marketplace platform called Idus where independent creators can sell handmade goods from foods to vintage goods. Idus is Etsy for the Korean market. Founded in 2014, they have helped independent handcrafters find new buyers and gave the opportunity to expose their product to potential buyers. As of 2020 August, the platform has surpassed 10 million downloads and has 4 million in MAU. There are about 2,0000 sellers on the platform. According to the company, 50% of Idus users are in their 20s and 90% are girls. Last year, Backpackr acquired one of the leading crowdfunding platforms called tumblebug to expand its business into arts, game, books and music.

My Real Trip, launched in 2012, is Korea’s leading online travel platform. The service began by matching individual tourists with local tour guides. Now they are an all in one tour platform providing travel products as well as travel services such as accommodations, flights, activities and others. Last year, the company diversified its business to survive the pandemic. Launching a live streaming tour service and jeju island tour products to focus on domestic travelers. According to the company, domestic travel sales have grown more than four times before the pandemic. With the recent funding of KRW 43.2 billion by domestic and overseas investors, My Real Trip plans to upgrade its search and recommendation algorithm and hire more staff to prepare for the post pandemic world.

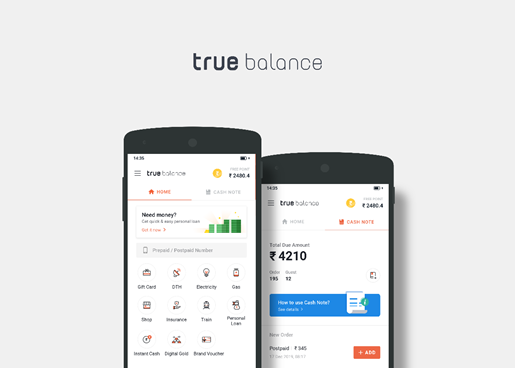

BalanceHero develops Truebalance, a finance platform for tens of millions of users in India. TrueBalance, a digital wallet app, enables users to access payment, loan, insurance, and other financial products. Launched in 2014, Truebalance began as an app to help users easily check their balance, purchase prepaid accounts and add funds. They have expanded their financial services by including online lending and it has become their core business. Balancehero raised KRW 3 million in a new financing round last year and expects to turn a profit in 2021.

![[StartupRecipe] South Korea Reaches 27 Unicorns](https://en.startuprecipe.co.kr/wp-content/uploads/2025/04/250420_unicorn_ai_00001-200x140.jpg)

![[StartupRecipe] South Korea’s Startup Investment Landscape 2025: 10 Key Findings](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260208_One-page-briefing_ai_00002-200x140.jpg)

![[StartupRecipe] Physical AI Tops Korean VC Investor Preferences in 2026](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260129_Startuprecipe-Investment-Report-_00001-200x140.jpg)

![[StartupRecipe] How Korea’s 10 Early-Stage Investors Performed in 2025](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260120_car-racing-desert_ai_5002305-200x140.jpg)

![[StartupRecipe] 85% of Korean Students Use AI, Few Know AI Startups](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260118_seoul_ai_00305035523-1-200x140.jpg)

![[StartupRecipe] Korea’s scale-ups are ditching Seoul and here’s why](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260107_deep-tech_ai_00000006-200x140.jpg)