Access to the latest Korean startup news and startup database for free

#Weekly Funding Overview

[Feb. 6 ~ Feb. 10]The total funds raised by Korean startups of this week is KRW 141.5 billion.

| Company | Inudustry | Amount | Round | Investors |

|---|---|---|---|---|

| Super block | Blockchain | 9 billion | Series A | SK, Netmarble, DSC Investment, E&Investment, Schmidt |

| Medibuilder | Medical Aggregator | 9 billion | Series A | LB investment, Bass Investment |

| i-Aurora | Fintech | - | Series A | YG PLUS |

| Forms | Virtual Human | - | Seed Bridge | D.CAMP |

| Ulift | Mobile coding | 2.5 billion | Pre-Series A | Bon Angels Venture Partners, Prodigy Investment, Access Ventures, Smilegate Investment, Pathway Partners, IP Ventures, Cosine Investment |

| Easytask | Gig worker platform | - | Seed | Firstgate |

| Soy Media | Web Content | - | Smartstudy Ventures | |

| Keybasic | Pettech | - | Seed | AI Angel club |

| Balawnpartners | Startup Consulting | - | Seed | CNTTech |

| Chaf | Gaming platform | - | Seed | The Ventures, Philosopia Ventures |

| Ludencity | Mental wellness | - | Seed | VNTG |

| Big Value | Prophtech | - | Pre-Series B | Yanolja Cloud |

| Pets lab | Pettech | - | M&A | Peopet |

| Indidlab | proptech | - | Grant | Tips |

| Reports | Leisure O2O | - | Seed | Incheon CCEI |

| NdotLight | 3D design Software | 8 billion | Series A | IMM Investment, Korea Development Bank, CJ Investment, Naver D2SF, Capstone Partners |

| Bitblue | Web3 | - | Seed | Mashup Angels |

| d'strict | Digital design | 100 billion | IMM Investment | |

| AgUni | Agriculture | - | Seed | Info Bank, IXV Lab, CNTTech |

| Cuttingedge | Creative media | - | M&A | F&F Holdings |

| AngelSwing | Contech | - | Hyndai Motors Zeroone | |

| Wiju | Agriculture | - | M&A | Adbiotech |

| Growv | Education | 6 billion | Series A bridge | KB Investment, TS Investment, Hyundai Investment Partners, SL Investment |

| Interx | Industrial AI solution | 5 billion | Korea Investment Partners, Lighthouse Combine Invest, Kingo Investment Partners | |

| Streami | Blockchain | - | Binance | |

| RTBP Aliance | Lifestyle brand | 2 billion | Smartstudy Ventures |

Major Funding

- D’strict, a company specializing in digital design, has bagged KRW 100 billion from SPC WaveOne of IMM Investment. D’stricted created “Wave,” a work of digital art displayed in COEX Square. It runs Arte Museum, an immersive media art exhibition hall in Jeju, Yeosu, and Gangneung. The company moved its headquarters overseas last year, aiming to expand globally.

- Blockchain mainnet startup Superblock has raised KRW 9 billion in funding. It is developing a mainnet called the Over network, which has lightweight nodes that ordinary users can run. This funding will be used to hire personnel to work on projects including mainnet, wallet, scan, and bridge that are expected to be released this year.

- Medical aggregator MediBuilder has received a KRW 9 billion investment. It has raised KRW 13 billion in total. It offers a model for co-founding a business management company optimized for each partner hospital. The team will use this money to concentrate on education, personnel management, development, and overseas marketing for the sustainable growth of hospitals.

- NdotLight has secured KRW 8 billion in investment. It made NdotCAD, a design studio with its own 3D engine that makes it simple to produce high-quality 3D assets. Its advantages are that it is easy to use and works well with other platforms like ZEPETO. It plans to target the B2B market by building a cloud-based 3D marketplace.

#Trend Analysis

Korean Startups secured over $14 Billion in 2022

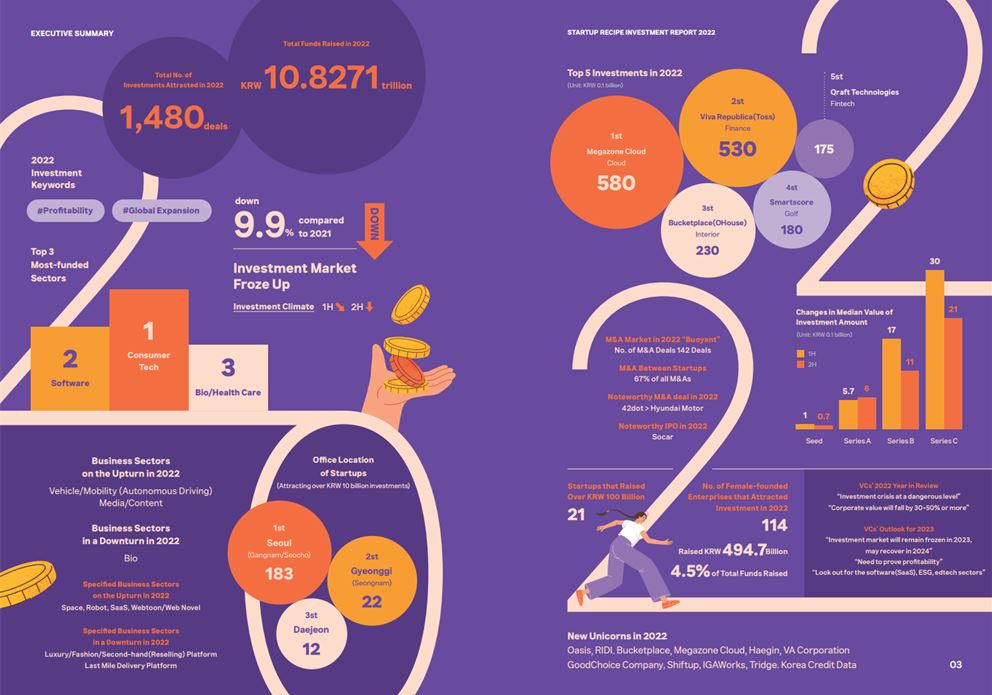

Startup Recipe, a Korean startup media, published a 2022 investment report and released information on the Korean startup investment ecosystem. According to the report, 1,480 investments totaling KRW 10.8271 trillion (8.4 billion) were made in Korean startups last year. The domestic investment market and the global market both struggled, with investments down 9.9% compared to 2021. In the second half of the year, the economic slump was in full swing and the investment market had frozen up. Investors sought capabilities to ensure specific profits rather than long-term growth prospects.

The industries that have garnered the most investments are consumer tech, software, and bio/healthcare. The vehicle/mobility sector, driven by autonomous driving, and the media/content sector, which drew attention thanks to K-contents, are two business sectors on the upturn in 2022. Fintech has been on the rise since 2021 and received many funds in 2022 as well.

The top 5 most funded startups in 2022 were Megazone Cloud, Viva Republica, Bucketplace, SmartScore, and Qraft Technologies. The M&A market was active even though the investment market was experiencing a downturn. In total, 142 M&A deals took place. Mergers and acquisitions between startups increased significantly, accounting for 67% of the total. Many claimed that winter had arrived, yet in 2022, multiple companies achieved unicorn status. There were eleven new unicorns: Oasis, RIDI, Bucketplace, Megazone Cloud, Haegin, VA Corporation, GoodChoice Company, ShiftUp, IGAWorks, Tridge, and Korea Credit Data.

Female entrepreneurs have raised KRW 494.7 billion, or 4.5% of the total investment. The figure fell by more than half compared to the previous year, and the overall ratio also decreased by more than 3%.

Korean venture capitalists predicted that while the investment climate would not be favorable in 2023, investments would still be made in certain sectors, such as B2B SaaS, ESG, and space industry. The Startup Recipe Investment Report 2022, which was produced with the support of D.CAMP, is available for free download from the website.

![[StartupRecipe] 3 Signs Korea’s Startup Funding is Back](https://en.startuprecipe.co.kr/wp-content/uploads/2026/03/260301_car-racing_ai_05032055-200x140.jpg)

![[StartupRecipe] South Korea Reaches 27 Unicorns](https://en.startuprecipe.co.kr/wp-content/uploads/2025/04/250420_unicorn_ai_00001-200x140.jpg)

![[StartupRecipe] South Korea’s Startup Investment Landscape 2025: 10 Key Findings](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260208_One-page-briefing_ai_00002-200x140.jpg)

![[StartupRecipe] Physical AI Tops Korean VC Investor Preferences in 2026](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260129_Startuprecipe-Investment-Report-_00001-200x140.jpg)

![[StartupRecipe] How Korea’s 10 Early-Stage Investors Performed in 2025](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260120_car-racing-desert_ai_5002305-200x140.jpg)

![[StartupRecipe] 85% of Korean Students Use AI, Few Know AI Startups](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260118_seoul_ai_00305035523-1-200x140.jpg)