Access to the latest Korean startup news and startup database for free

#Weekly Funding Overview

[May. 31~ June. 4 ]The total funds raised by Korean startups of this week is KRW 237.6 billion.

| Company | Inudustry | Amount | Round | Investors |

|---|---|---|---|---|

| DNKOREA | Prophtech | 4.6 billion | NFX, Flybridge, MetaProp | |

| Mustit | Fashion | 13 billion | Kakao Investment, K2 Investment Partners | |

| DNKorea | Prophtech | 4.6 billion | Seed | NFX, Flybridge, Metaproph |

| Ably Corporation | Fashion | 62 billion | Series B | SV Investment, Premier Partners, Intervest, Stic Ventures, Smilegate Investment, Capstone Partners, L&S Venture Capital |

| Furiosa | AI Semiconductor | 80 billion | Series B | Naver, DSC Investment, Korea Development Bank, Korea Omega Investment, Quantum Ventures Korea, IMM InvestmentAion Asset Management |

| Humart Company | Mental healthcare | 3 billion | L&S Venture Capital, KDB Capital, ID Ventures | |

| WeTrain | Fitness | 300 million | Pre-Series A | MAGNA Investment |

| Bodayworks | Fitness | - | Seed | Primer |

| StudySenior | Education | 10 billion | Series B | Synergy IB InvestMent, Alpha Vista Investment, PolarisPE, SU&Financial Investment, |

| Mobidoo | commerce | 6 billion | Series B | TS Investment, KB Securities, SBI Investment Korea, Hana Financial Investment, Future Play, Shinhan Capital, Sparklabs, Mobidays, Samsung Next, Lotte Ventuers |

| Twave | Fintech | 3 billion | Pre-Series B | Pathfinder H, Intellectural Discovery |

| Bertis | Healthcare | 15 billion | SK Telecom, SK Planet | |

| Suriking | Phone repair | - | Seed | Mashup Angels |

| Espresomedia | Video | - | Naver D2SF | |

| Voithru | Media/Content | 6 billion | Series B | Hahsed, TBT, KB Investment |

| Phonair | Media/Content | - | Seed | The invention lab |

| Jaranda | Kids Education | 9.7 billion | Series A bridge | Korea Investment Partners, Korea Development Bank, Daekyo, Daekyo Investment, IP Ventures, TIGRIS investment |

| Musiccow | Media/Content | 17 billion | Series C | Korea Development Bank, LB Investment, WSWGStudio, Korea growth investment |

| Caredoc | Silver care | 8 billion | Murex Partners, Lotte Ventures, Hyundai Marine & Fire Insurance Co, Insight Equity Partners, Hana Bank, Humax | |

| Clayful | commerce | - | M&A | Sixshop |

| Memer D | Sport | - | Kolonglotech |

Major Funding

- AI semiconductor startup Furiosa raised KRW 80 billion in Series B investment. The company is developing semiconductors that can maximize AI performance in data centers and enterprise servers. They will focus on securing talent for next-generation chip development In the second half of 2022.

- Music copyright trading platform MusicCow raised KRW 17 billion. Since the service launched in July 2017, 850 songs have been traded so far. The number of users increased by 438%, and the transaction volume increased by 368% compared to the previous year.

- Luxury fashion platform Must It raised KRW 13 billion. The company achieved an 80% annual average growth rate and KWR 250 billion in transactions and is number 1 in market share. They plan to establish a partnership and collaborate with Kakao through this investment.

- Childcare matching platform Jarada raised KRW 9.7 billion investment. The company has accumulated an investment of KRW 13.8 billion, the largest in the industry. Sales in the first quarter rose 46% compared to the previous quarter, with a total of 83,000 teachers, and monthly transactions increased 3.5 times compared to last year. They plan to implement customized content recommendations through regional expansion, service age expansion, and child propensity analysis with investment.

#Trend Analysis

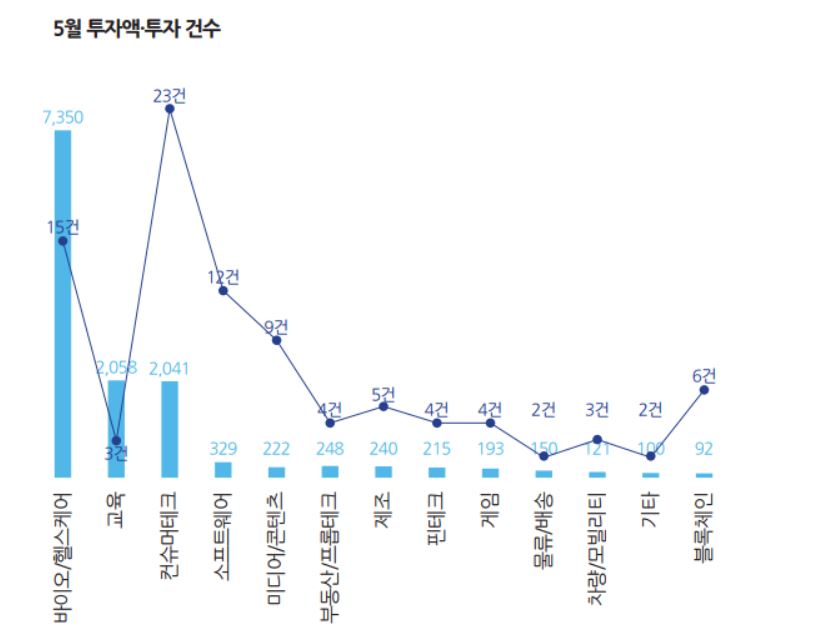

Funding surges in May due to inflow of foreign capital

The amount attracted by Korean startups exceeded KRW 1 trillion in May. Analysts say that this phenomenon occurred when a large amount of global foreign capital flowed into Korean startups in May. This is almost equal to the total amount invested in the first quarter of this year. Typical examples include the healthcare service Noom($540 million) and AI education company Riiid($ 175 million), which accounted for more than 60% of the total investment amount. In addition, Team Blind (workplace community), Prophtech, and Home cleaning have raised investment from overseas venture capitals.

By sector, Healthcare Service Num, established in the U.S. by a Korean founder, succeeded in making a significant investment, ranking first in overall investment. Avely, Korea’s No. 1 women’s fashion platform, attracted a large-scale investment of KRW 62 billion, followed by lifestyle services such as home cleaning, laundry, and food attracted a large number of investments, and funds were also concentrated in Consumer Tech startups.

There is also a phenomenon in which investments are concentrated in startups in Series A or higher rather than seed-level investments. The phenomenon of investing in profitable companies rather than initial investments with large risk factors became more evident in May. The number of seed investments is less than the number of Series A investments.

News of global-level acquisitions followed. Kakao simultaneously acquired Web novel Tapas Media and Radish for KRW 1.1 trillion to strengthen its global content IP business. Its strategy is to strengthen its position in the global market by acquiring Korean startups well-known abroad. Kakao is also delivering K-content overseas through these two platforms. Women’s fashion app StyleShare and 29CM were sold to Musinsa for KWR 300 billion. Fashion platform is the hottest area in South Korea’s investment market recently. In particular, investment is concentrated on platforms targeting women. In this market, competition between existing large companies and startups with strengths in the online space is unfolding. In a situation where there is no market leader, each company is trying to grow in size and secure competitiveness with their strategies.

Cases of large corporations investing in startups are increasing. Large companies are joining hands with shared offices to cope with the work environment that has changed to Covid-19. SK Telecom has become the largest shareholder of Korean shared office brand SparkPlus by securing more than 30% of shares. Mirae Asset Group also invested KRW 20 billion. SK Telecom is expected to actively utilize Spark Plus to implement a work anywhere environment.

![[StartupRecipe] South Korea’s Startup Investment Landscape 2025: 10 Key Findings](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260208_One-page-briefing_ai_00002-200x140.jpg)

![[StartupRecipe] Physical AI Tops Korean VC Investor Preferences in 2026](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260129_Startuprecipe-Investment-Report-_00001-200x140.jpg)

![[StartupRecipe] How Korea’s 10 Early-Stage Investors Performed in 2025](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260120_car-racing-desert_ai_5002305-200x140.jpg)

![[StartupRecipe] 85% of Korean Students Use AI, Few Know AI Startups](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260118_seoul_ai_00305035523-1-200x140.jpg)

![[StartupRecipe] Korea’s scale-ups are ditching Seoul and here’s why](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260107_deep-tech_ai_00000006-200x140.jpg)

![[StartupRecipe] The Rise of U.S.-Based Korean Startups](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/251229_Aerial-drone-photography_ai_00001-200x140.jpg)