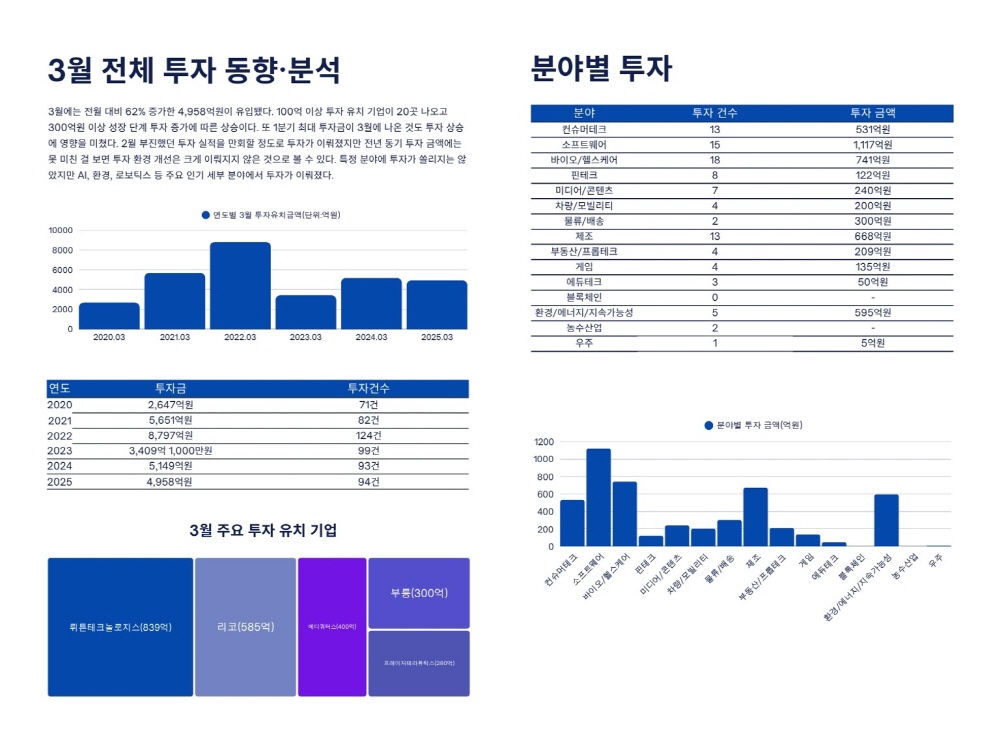

Investment in Korean startups rebounded significantly in March 2025, with KRW 495.8 billion flowing into the ecosystem. While this represents a slight decrease compared to March 2024, it marks a substantial 62% increase from February 2025, helping the first quarter end on a positive note after a sluggish February. Three of the five largest investments in Q1 2025 occurred in March, significantly contributing to the recovery in overall investment performance.

AI service platform Wrtn Technologies secured the largest funding round of the month, raising KRW 83 billion—making it the top investment both in March and across the entire first quarter. Other major deals included B2B waste management platform Reco (KRW 58.5 billion), fashion platform Mediquarters (KRW 40 billion), and delivery service platform Vroong (KRW 30 billion). Notably, three of these companies ranked among the top five investments for the quarter.

The software sector, led by AI platforms, attracted the most capital in March. The biotech and healthcare sectors also remained popular throughout the month and were among the most well-funded sectors in Q1. Consumer technology showed notable improvement, with steady investment in fashion, beauty, and lifestyle categories throughout the quarter.

March saw a more balanced distribution of investments across sectors, including logistics, real estate, and proptech—areas that had previously underperformed—with each securing investments of around KRW 10 billion. While no funding round surpassed the KRW 100 billion mark, the number of companies raising over KRW 10 billion nearly doubled from February, reaching 20. Four late-stage startups (Series B or later) each raised more than KRW 30 billion, driving the overall increase in March’s investment volume. No investment in Q1 2025 exceeded KRW 100 billion.

There were no notable mergers and acquisitions in March, and the first quarter saw only one significant M&A event: LG Electronics’ acquisition of Bear Robotics.

Top-funded companies in March, such as Wrtn Technologies and Reco, attracted attention from global investors. However, a review of the entire quarter shows that global investment firms primarily backed U.S.-based companies founded by Korean entrepreneurs, rather than Korea-based startups. The influx of new global investors into the Korean ecosystem remained limited.

Investments in female-founded startups in March totaled just KRW 4.2 billion, most of which were early-stage. The largest investment received by a female-led startup in Q1 was Sizzle’s KRW 23.7 billion, which was also the only female-led company to raise over KRW 10 billion. This highlights that investment in female-founded startups remains heavily concentrated in the early stages.

Top 15 Startup Investments in March

| Company Name | Industry | Investment Amount | Investment Stage |

| Wrtn Technologies | AI Platform | 83 billion KRW | Series B |

| Reco | B2B Waste Management | 58.5 billion KRW | Series C |

| Mediqauters | Fashion Beauty Brand Platform | 40 billion KRW | Series D |

| Vroong | Delivery Platform | 30 billion KRW | Undisclosed |

| Fraser Therapeutics | Next-generation Targeted Protein Degradation | 28 billion KRW | Series B |

| Contoro Robotics | Robotics | 17.5 billion KRW | Series A |

| Gudo Planning | Real Estate Development/Hotel &Residence Operation | 16.7 billion KRW | Undisclosed |

| Seadronix | Autonomous Ship Navigation | 15 billion KRW | Series B |

| ECI | Automotive Parts Manufacturing | 15 billion KRW | Undisclosed |

| Offbeat | Game Developer | 13.5 billion KRW | Undisclosed |

| MediThingQ | Medical XR Wearable Display | 12.4 billion KRW | Series B |

| GenGenAI | AI Synthetic Data Technology | 12 billion KRW | Series A |

| Daim Bio | Drug Development | 12 billion KRW | Series A |

| Digitron | Defense Electronic Equipment | 12 billion KRW | Undisclosed |

| Karis Bio | Cell Therapy | 11.5 billion KRW | Series B |