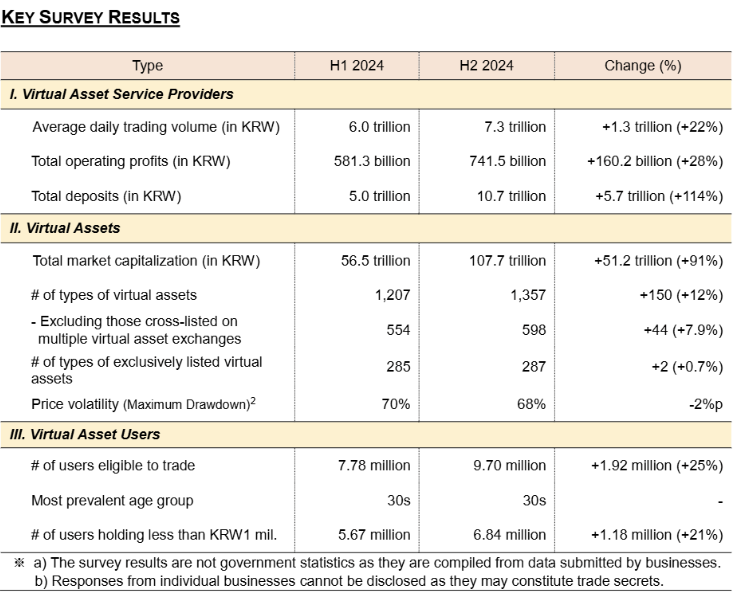

The Korea Financial Intelligence Unit (KoFIU) released the results of its latest survey on the domestic virtual asset market, revealing substantial growth in key market indicators during the second half of 2024. The findings are based on data collected from 25 registered virtual asset service providers (VASPs).

According to the report, the Korean virtual asset market saw accelerated expansion following the upward trend that began in the second half of 2023. Compared to the first half of 2024, average daily trading volume increased by KRW 1.3 trillion (22%), total operating profits rose by KRW 160.2 billion (28%), and the number of eligible users jumped by 1.92 million (25%).

The most significant surges were recorded in market capitalization, which soared KRW 51.2 trillion (91%), and total deposits, which grew by KRW 5.7 trillion (114%)—indicating robust investor confidence and liquidity inflows.

Despite the overall market growth, coin-only exchanges suffered sharp declines across several metrics. Average daily trading volume for these platforms fell by KRW 660 million (81%), market capitalization dropped by KRW 27.6 billion (19%), and operating profits declined by KRW 1.1 billion (8%). KoFIU attributed this to increased user concentration in KRW-based exchanges and the shutdown of certain coin-only service providers.

In terms of virtual asset transfers, the report noted a modest 4% increase in transfers to registered entities under the travel rule. However, transfers to whitelisted overseas entities and personal digital wallets surged by 38%, suggesting growing international and self-custodial activity.

Meanwhile, custody, wallet, and staking services saw significant contraction. The total volume of assets in these services plummeted by KRW 12.3 trillion (89%), and the number of users decreased by 196,000 (99%). KoFIU linked this decline to the exit of several service providers and a drop in the base value of certain custody assets.