Naver’s in-house corporate venture capital arm, Naver D2SF(D2 Startup Factory), celebrated its 10th anniversary with a roundtable event on May 13. The company reflected on a decade of strategic early-stage investments and revealed its vision for global expansion in the coming years.

Unlike conventional CVCs that operate as subsidiaries focused on both financial and strategic returns, Naver D2SF functions as an internal team with a primary emphasis on strategic value. Notably, 99% of its 115 investments have been in seed to Series A startups.

“This structure allows us to invest from a long-term perspective without financial pressure,” said Yang Sang-hwan, Head of Naver D2SF. “Rather than chasing short-term profits, we aim to build sustainable collaborations with startups.”

Since its founding, Naver D2SF has backed 115 startups, most of them at the earliest stages of growth. The combined enterprise value of these startups has reached approximately KRW 5.2 trillion, a fourfold increase compared to 2021. Furthermore, 64% of its portfolio companies are actively collaborating with Naver.

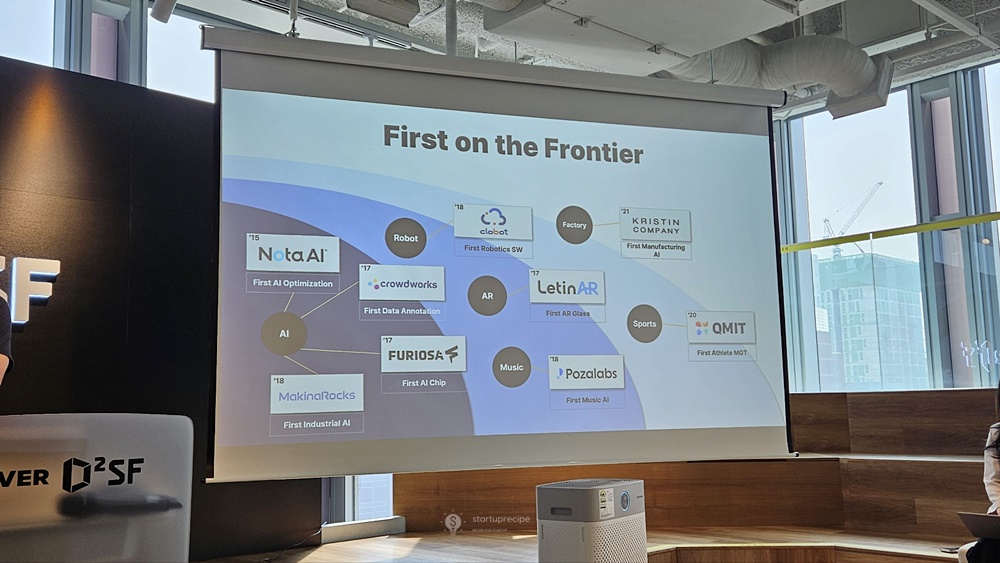

Yang emphasized D2SF’s ‘frontier’ investment approach—targeting startups that are creating new markets rather than entering existing ones. Notable investments include AI optimization firm NotaAI, data labeling platform Crowdworks, semiconductor developer FuriosaAI, industrial AI company MakinaRocks, and robot software startup Clobot.

One standout case is FuriosaAI, which reportedly turned down a KRW 1 trillion acquisition offer from Meta. D2SF invested in the company even before its official founding in 2016 and has continued to support it through multiple rounds.

Artificial intelligence accounts for 54% of Naver D2SF’s investments, followed by immersive tech, health, robotics, and mobility. Despite the inherent risk of early-stage investments, the portfolio maintains a 96% survival rate. On average, startups progress from seed to pre-Series A within 18 months.

Beyond capital, Naver D2SF focuses heavily on startup growth support. It has invested around KRW 20 billion in value-up programs and community-building initiatives. These include six key stages: leveraging Naver experts, organizing one-on-one meetings, offering tailored growth programs, facilitating peer exchanges, forming CEO communities, and driving synergy with Naver business units. Yang noted, “Startups that actively used our value-up programs grew at a rate nine times higher than those that didn’t.”

During the event, startup founders also shared insights into Korea’s current investment landscape. Yang commented, “The market is tough right now. While B2C unicorns exist, Korea still lacks deep-tech unicorns. We’re in a transitional phase that requires new strategies.”

Yang Soo-young, CEO of Techtaka, remarked, “The market is clearly filtering out weak players. Still, we see opportunities in the global growth of K-beauty and are expanding into the U.S. and Japan.” Techtaka currently partners with Naver to offer seven-day-a-week delivery services.

Choi Byeol-i, CEO of Movin—a startup born from Naver’s Campus Competition—said, “We’ve never experienced an investment boom, but Naver’s support made a big difference.” Movin focuses on 3D content and motion capture, targeting markets in North America and Japan.

Currently, 81% of Naver D2SF-backed startups are pushing into overseas markets. Last October, D2SF established operations in Silicon Valley to support this push.

“After 10 years, many of our portfolio startups realize that global expansion is critical,” Yang said. “Korea is a limited market. Startups need access to broader markets, more capital, and stronger global partnerships. Based on our experience, we aim to become a bridgehead for Korean startups seeking global growth.”