|

Q3 2024 Financial Highlights:

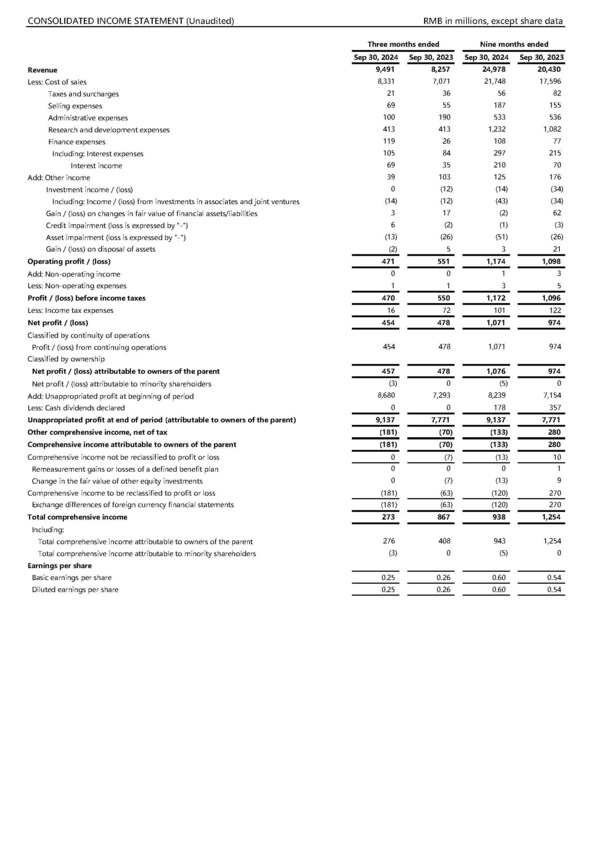

- Revenue was RMB 9.49 billion, an increase of 14.9% year-on-year and 9.8% quarter-on-quarter, a record quarter in the company’s history.

- Net profit attributable to owners of the parent was RMB 0.46 billion. Net profit attributable to owners of the parent after deducting non-recurring gains and losses was RMB 0.44 billion, an increase of 19.5% year-on-year.

Q3 YTD 2024 Financial Highlights:

- Revenue was RMB 24.98 billion, an increase of 22.3% year-on-year, a record high in the company’s history.

- Net profit attributable to owners of the parent was RMB 1.08 billion, an increase of 10.6% year-on-year.

- Earnings per share was RMB 0.60, as compared to RMB 0.54 in Q3 YTD 2023.

SHANGHAI, Oct. 25, 2024 /PRNewswire/ — Today, JCET Group (SSE: 600584), a leading global provider of integrated circuit (IC) back-end manufacturing and technology services, announced its financial results for the third quarter of 2024. The financial report shows that in the third quarter of 2024, JCET achieved revenue of RMB 9.49 billion, an increase of 14.9% year-on-year, a record quarter in the company’s history, and net profit attributable to owners of the parent of RMB 0.46 billion. Net profit attributable to owners of the parent after deducting non-recurring gains and losses was RMB 0.44 billion in Q3 2024, an increase of 19.5% year-on-year. In Q3 YTD 2024, JCET achieved revenue of RMB 24.98 billion, an increase of 22.3% year-on-year, a record high in the company’s history, and net profit attributable to owners of the parent of RMB 1.08 billion, an increase of 10.6% year-on-year.

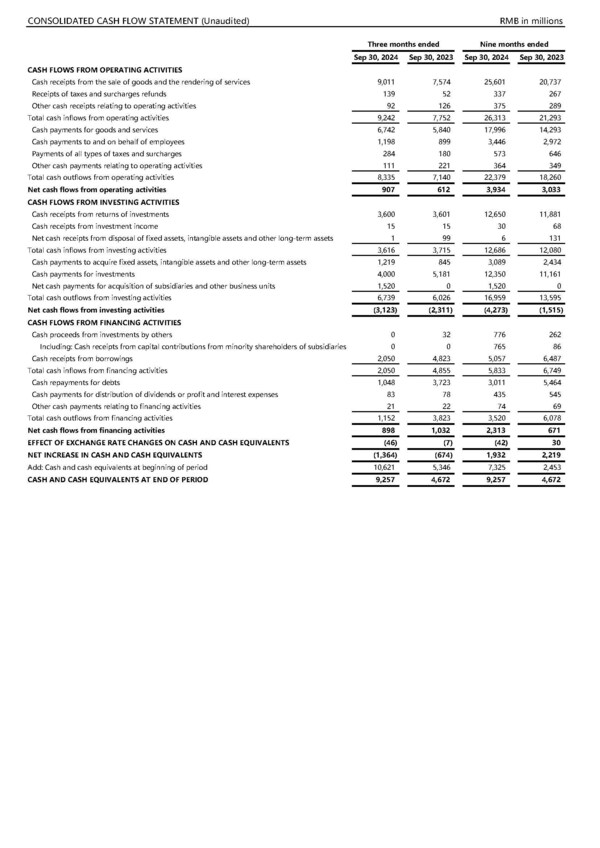

The operations of JCET factories have rebounded since 2024, and the company’s capacity utilization rate is continuously increasing. In the first three quarters of this year, all business sector recovery has stabilized, and the company’s earlier strategic layout began to contribute incremental growth. In the first three quarters, the revenues of the four major applications, including communications, consumer, computing, and automotive electronics all achieved double-digit year-on-year growth, with communication electronics achieving a significant growth of nearly 40% year-on-year. The company strengthened inventory control and supply chain management to ensure efficient circulation of capital, generating RMB 3.93 billion cash from operations in Q3 YTD 2024, a year-on-year increase of 29.7%.

JCET’s acquisition of 80% equity of SanDisk (Shanghai), a global leading factory for memory chip packaging, has completed. This will further enhance the company’s intelligent manufacturing and expand its market share in the memory and computing electronics. JCET microelectronics microsystem integration high-end manufacturing base has been put into use, providing one-stop IC back-end manufacturing services and addressing global customers’ demand for high-performance chips.

Mr. Li Zheng, CEO of JCET, said, "JCET has actively promoted innovation in advanced packaging technology and capacity layout in recent years. Since the beginning of this year, the company business has continued to rebound, and its revenue in the first three quarters hits a new high in the company’s history. JCET will continue to focus on advanced technology and high value-added markets to support sustainable development."

For more information, please refer to the JCET Q3 2024 Report.

About JCET Group

JCET Group is the world’s leading integrated-circuit manufacturing and technology services provider, offering a full range of turnkey services that include semiconductor package integration design and characterization, R&D, wafer probe, wafer bumping, package assembly, final test and drop shipment to vendors around the world.

Our comprehensive portfolio covers a wide spectrum of semiconductor applications such as mobile, communication, compute, consumer, automotive, and industrial, through advanced wafer-level packaging, 2.5D/3D, System-in-Package, and reliable flip chip and wire bonding technologies. JCET Group has two R&D centers in China and Korea, eight manufacturing locations in China, Korea, and Singapore, and sales centers around the world, providing close technology collaboration and efficient supply-chain manufacturing to our global customers.