Access to the latest Korean startup news and startup database for free

#Weekly Funding Overview

[Sep. 25 ~ Sep. 29]The total funds raised by Korean startups of this week is KRW 72.1 Billion.

| Company | Inudustry | Amount | Round | Investors |

|---|---|---|---|---|

| MitoImmune Therapeutics | Bio | 5.2 billion | BNC, K-Ground Ventures, BMI | |

| Noutecompany | Digital stationery | 2.5 billion | Goodnote, Strongventures | |

| Tripsoda | Travel commnunity commerce | 800 million | Seed | Primersazze, Soppong Ventures |

| AimBe lab | Livestock Industry | - | Pre-Series A | Korea investment accelerator |

| Curaum | Medical device | 10.6 billion | Series B | CKD VENTURE CAPITAL, Etri Holdings Daily Partners, Shinhan Capital, IBK Industrial Bank, Samsung Securities, Hyundai Technology Investment, Korea Venture Investment, Roi Investment Partners |

| XL8 | AI Translation | 10 billion | Series A | KB Investment, Atinum Investment |

| Neocannbio | 10 billion | Series B | Quad Asset Management, Bilanx Investment, Donghoon Investment, Prologue Ventures, MedytoxVenture, HLB Investment, BM Ventures | |

| Tripod Lab | Foodtech | - | Grant | TIPS |

| Futurism Labs | Fintech | - | Grant | TIPS |

| Squadx | Shortform commerce | - | Seed | Cnttech |

| Growv Edu | Edutech | 18 billion | Series B | LG U+, Hana Ventures, KB Investment, Midas Dong-A Investment |

| Fine one | Display materials | 15 billion | Series C | Innopolis Partners, KDB Development Bank, A Ventures, TS Investment, Daedeok Venture Partners |

| Newlook | Korean traditional Beverage | - | Seed | The Ventures |

| Theoneder | Building Management | - | Seed | Bass Investment, Soppong Ventures |

| Superworks Company | Brand consulting | - | Seed | Cnttech |

| HB Smith | QA | - | Grant | Post Tips |

| VPPlab | Renewable Energy IT Platform | - | Grant | Deeptech TIPS |

| 3-youth | Medical device | - | Grant | TIPS |

Major Funding

- EduTech company GrowV Edu has attracted an additional investment of KRW 18 billion, achieving a total investment of KRW 44 billion. Their flagship product ‘Superv’ provides customized smart educational content in English, math, and Korean for children aged 4 to 8 through dedicated tablets.

- Fine One has secured an investment of KRW 15 billion. The company succeeded in localizing the key component, the magnet plate, in the OLED display deposition process and achieved sales of KRW 40.6 billion last year.

- Specialized healthcare medical device company Curaum has secured KRW 10.6 billion in funding. Curaum develops next-generation medical services by integrating oral sensors and Software as a Medical Device (SaMD), providing the device ‘Oralog’ for treating chronic sleep disorders.

- AI translation startup XL8 has attracted an investment of KRW 10 billion. Operating and developing the ‘MediaCat’ solution for localizing media content, the investment will accelerate their entry into the markets of the United States, Europe, and the Middle East.

#Trend Analysis

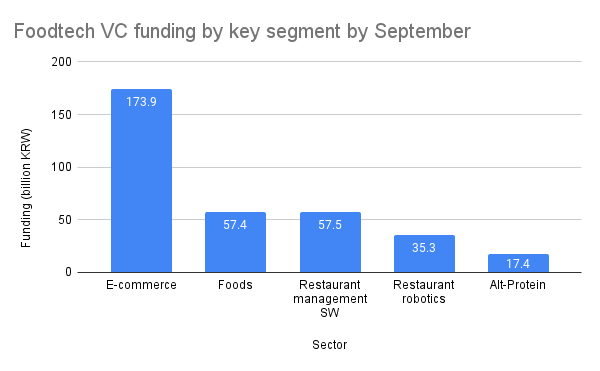

The Thriving Foodtech Investment Sector

In the face of a recent downturn in startup funding, the foodtech industry remains a focal point for investors, buoyed by the prevailing investment landscape. According to data from Startuprecipe, foodtech startups have secured a KRW 3469 million in funding by September of this year. This resilience is underscored by several significant transactions, indicative of sustained interest and commitment within the sector. Notably, investment emphasis has leaned towards Series B and higher stages.

Investment focus primarily orbits around food e-commerce and pioneering startups dedicated to revolutionizing restaurant operations through digital means, encompassing functions like reservations and payments. While e-commerce has commanded the lion’s share of investments, it is worth noting that numerous e-commerce enterprises, originally eyeing public listings, have opted for postponements due to the prevailing market conditions.

The venture into alternative meats, notably cultured meat, has experienced a measured pace, marked by a sparse number of large-scale investments. However, seed investments persist, foreshadowing a surge in interest towards alternative food sources in response to the global climate shift. Additionally, the rise of ‘robots as a service’ in kitchen and restaurant environments will be a salient feature of the industry this year. Startups specializing in unmanned and automated solutions, exemplified by kitchen and serving robots, promise enhanced operational efficiency and reduced labor costs, ensuring they remain on investors’ radars.

| Company | Description | Funding (Billion won) | Round |

| Kurly | E-commerce | 120 | Pre-IPO |

| Smartfood networks | Food distribution | 40 | Series B |

| Ignis | Functional food | 34.8 | Series B |

| WAD | Restaurant management | 30 | Series D |

| Payhere | Restaurant management | 20 | Series B |

| Bbodeck | Dishwashing system | 18 | Series B |

| Cellmeat | Cultured meat | 17.4 | Series A |

| Sweetbio | Foods | 10.5 | Series B |

![[StartupRecipe] 3 Signs Korea’s Startup Funding is Back](https://en.startuprecipe.co.kr/wp-content/uploads/2026/03/260301_car-racing_ai_05032055-200x140.jpg)

![[StartupRecipe] South Korea Reaches 27 Unicorns](https://en.startuprecipe.co.kr/wp-content/uploads/2025/04/250420_unicorn_ai_00001-200x140.jpg)

![[StartupRecipe] South Korea’s Startup Investment Landscape 2025: 10 Key Findings](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260208_One-page-briefing_ai_00002-200x140.jpg)

![[StartupRecipe] Physical AI Tops Korean VC Investor Preferences in 2026](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260129_Startuprecipe-Investment-Report-_00001-200x140.jpg)

![[StartupRecipe] How Korea’s 10 Early-Stage Investors Performed in 2025](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260120_car-racing-desert_ai_5002305-200x140.jpg)

![[StartupRecipe] 85% of Korean Students Use AI, Few Know AI Startups](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260118_seoul_ai_00305035523-1-200x140.jpg)