Access to the latest Korean startup news and startup database for free

#Weekly Funding Overview

[May. 26~ May. 30]#FUNDING

| Company | Inudustry | Amount | Round | Investors |

|---|---|---|---|---|

| libertylabs | SME Employee Ownership Transition | 13 billion | Pre Series A | SBVA, Smilegate Investment |

| AIPL | AI Autonomous Manufacturing Solution | - | Seed | Schmidt, Kingsley Ventures |

| Showplus | Video Contest Platform | - | Araa | |

| PIECE PEACE STUDIO | Fashion Apparel Brand | - | IGIS Asset Management | |

| Bon Systems | Robot Company | 5 billion | Series A | Pathfinder H, Hyundai Investment Partners, IBK Securities |

| Safe Kitchen | Cleaning Subscription Service for Restaurants | - | Seed | Seoul National University Technology Holdings |

| MultiScale Instrument | Atomic Microscope for Semiconductor In-line Processes | - | Seed | Korea Investment Accelerator, Bluepoint Partners, Samick MATS Ventures |

| P2ACH AI | AI Outdoor Advertising Solution | - | Grant | Deeptech TIPS |

| Feat | Document Sharing Solution | - | Pre Series A | Hyundai Investment Partners |

| Shin Starr presents | Food Tech | 5 billion | Series A Bridge | Translink Investment, CJ Investment, Bilanx Investment |

| STUDIO META-K | Content IP Production | 1 billion | Series A | Timeworks Investment |

| Furiosa AI | AI Chip | - | JW Asset Management, Konan Investment | |

| OOZE Studio | Beauty Branding Studio | - | MARK-SOLIDONE BEAUTY INTELLIGENCE FUND No. 1 | |

| CTRL-M | AI Food Tech Solution | - | Grant | TIPS |

| KlAP | Music Label | - | M&A | Blitzway Entertainment |

| Homi AI | Generative AI | - | Seed | Hustle Fund |

| Hypervisual AI | On-Device Vision Intelligence Solution | - | K-Ground Ventures | |

| 3Y Corporation | Digital Content | - | M&A | ATU Partners |

| After company | Omnichannel Cloud Service | - | Grant | TIPS |

#TREND ANALYSIS

ICT GROWTH Drives Korean Tech Startups Global

South Korea’s startup ecosystem continues to gain momentum under strong government leadership, with the development of unicorn companies positioned as a key national objective. The Ministry of Science and ICT is driving this initiative through the Global ICT Future Unicorn Development Program (ICT GROWTH), which provides strategic support for high-potential startups aiming to expand into global markets.

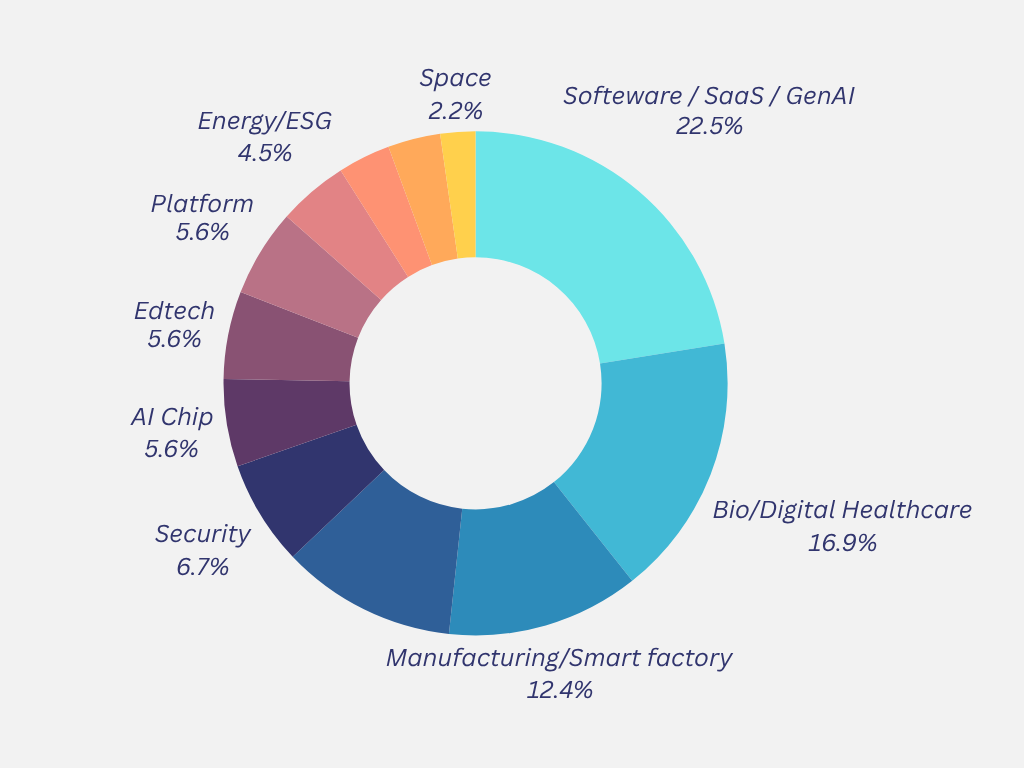

Launched in 2020, the ICT GROWTH program has supported 89 companies to date, including 15 newly selected in the most recent round. According to an analysis by StartupRecipe, which applied its proprietary classification system, the selected companies reflect broader trends in Korea’s ICT sector and global technology markets.

Software companies, including SaaS and generative AI providers, led the cohort with 20 companies (22.5%), highlighting software’s continued role as the core engine of Korea’s ICT industry. The bio, healthcare, and digital health sector followed with 15 companies (16.9%), underscoring rapid growth in digital healthcare innovation. Manufacturing, smart factory, and advanced materials companies accounted for 11 selections (12.4%), demonstrating increased demand for the digital transformation of traditional industries. AI semiconductor startups also drew attention, making up 5.6% of the total.

These figures align closely with Korean investment trends, suggesting that ICT-based convergence companies are actively positioning themselves for international growth.

Numerous companies supported by the program have achieved substantial milestones. Firms such as CrowdWorks (AI training data), OpenEdge Technology (AI semiconductor IP), SensorView (5G solutions), Smart Radar Systems (4D radar sensors), and InnoSimulation (XR simulation) have gone public, validating the market potential of ICT GROWTH participants.

Companies selected between 2022 and 2024 collectively reported strong performance, including KRW 139.9 billion in investment, KRW 401 billion in revenue, 1,113 new hires, and 245 domestic and international patent applications.

Notable startups include FuriosaAI, which attracted attention after declining an acquisition offer from Meta, and Wrtn Technologies, which secured a large-scale investment exceeding KRW 100 billion. Other globally active participants include H2O Hospitality, which entered Middle Eastern markets with its accommodation solutions; Elice, which is expanding AI education platforms from Singapore; Robo Arete, operating robotic food services in New York; and Qanda, targeting the U.S. market with its mathematics app via Vietnam.

Despite many success stories, not all companies have fared well. LinkShops, one of the past participants, has entered court-led rehabilitation. Moreover, IPO activity among ICT GROWTH alumni has slowed compared to the 2020–2023 period.

The ICT GROWTH program is distinguished from the Ministry of SMEs and Startups’ unicorn initiative by its exclusive focus on ICT-related startups and its emphasis on global expansion. Rather than offering direct financial support, the program provides tailored assistance through networking, mentoring, and market entry support based on international bases operated by the Ministry in Silicon Valley, Singapore, Vietnam, and India.

For the 2025 cohort, eligibility criteria include having attracted over KRW 2 billion in investment within the past three years or achieving an average annual revenue growth rate exceeding 20%. Selected companies will gain access to accelerator partnerships, customized mentoring, participation in global events, and business matching opportunities in up to two international regions.

In a challenging investment climate, Korean startups are increasingly prioritizing revenue generation and international expansion as core survival strategies. For those targeting global markets, programs like ICT GROWTH offer critical infrastructure and opportunities to break through barriers and establish a competitive global presence.

#MORE NEWS

- South Korea’s Beauty Industry Reaches Record-Breaking Heights in 2024

- South Korea Selects 50 ‘Baby Unicorn’ Startups in 2025

- Korea’s LICORN Program Selects 160 Small Businesses

![[StartupRecipe] 3 Signs Korea’s Startup Funding is Back](https://en.startuprecipe.co.kr/wp-content/uploads/2026/03/260301_car-racing_ai_05032055-200x140.jpg)

![[StartupRecipe] South Korea Reaches 27 Unicorns](https://en.startuprecipe.co.kr/wp-content/uploads/2025/04/250420_unicorn_ai_00001-200x140.jpg)

![[StartupRecipe] South Korea’s Startup Investment Landscape 2025: 10 Key Findings](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260208_One-page-briefing_ai_00002-200x140.jpg)

![[StartupRecipe] Physical AI Tops Korean VC Investor Preferences in 2026](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260129_Startuprecipe-Investment-Report-_00001-200x140.jpg)

![[StartupRecipe] How Korea’s 10 Early-Stage Investors Performed in 2025](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260120_car-racing-desert_ai_5002305-200x140.jpg)

![[StartupRecipe] 85% of Korean Students Use AI, Few Know AI Startups](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260118_seoul_ai_00305035523-1-200x140.jpg)