Access to the latest Korean startup news and startup database for free

#Weekly Funding Overview

[April. 12~ April.16]The total funds raised by Korean startups of this week is KRW 88.6 billion.

| Company | Inudustry | Amount | Round | Investors |

|---|---|---|---|---|

| Uprise | Fintech | 9 billion | Series B | Hashed, Shinhan Venture, KB Invesment, We Ventures, Neoflux, Kakao Ventures |

| Marqvision | AI | 3.6 billion | Seed | Ycombinator, Bass Invesment. Danal Investment partners |

| Vestellalab | Software | - | Series A | Aju IB, Honest Ventures |

| Wart | ART | - | Series A | MYSC, EUGENE INVESTMENT, The wells Investment, Woori bank, SBA, Korea Credit Guarantee Fund |

| Omolle | Fitness | - | GRANT | TIPS |

| Unizaar | Beauty | - | Seed | New Paradigm Investment |

| Tessa | ART | - | Seed | CNTTech |

| Hubis | Manufacture | 3 billion | Series A | Kiwoom Investment, Innopolis Partners |

| The Capsule | Hotel | - | Seed | N15 |

| Braingear | Bio/Healthcare | - | Seed | CCEI Incheon |

| Elinha | Beauty | - | Pre-Series A | TBT |

| SOYNET | Software | - | GRANT | TIPS |

| Standard energy | Battery | 10 billion | Softbank Ventures | |

| Value of Space | Prophtech | - | Pre-Series A | Bass Investment, KB investment |

| Starstech | Sustainability | - | Series B | NH Investment & Securities |

| Croquis | Fashion | - | M&A | Kakao |

| Bank Salad | Fintech | 25 billion | Series D | KT |

| Butfitseoul | Fitness | 2 billion | Kakao Ventures, Capstonepartners, BA Partners, Worksit | |

| Urivetkorea | Pettech | - | Seed | D2SF |

| Small ticket | Insuretech | - | Alticast | |

| Rudacure | Bio/Healthcare | 15 billion | Hanlim pharm | |

| Cashmallow | Fintech | - | Seed | JB Ventures |

| Jober | Software | - | Pre-Series A | Strong Ventures, Hana Bank, D.camp |

| Brandy | Fashion | 10 billion | Korea Development Bank | |

| Connext | Bio/Healthcare | 5 billion | LSK Investment, KB Investment, Thewells Investment | |

| Crema | Software | 4 billion | Series A | SV Investment, Bass Investment |

Major Funding

- BankSalad has raised KRW 25 billion in Series D investment from KT. Amid rumors of KT acquiring the company, it secured KWR 25 billion out of KRW 100 billion in advance and resolved financial difficulties. BankSalad is preparing ‘MyData’ business and is expected to collaborate with KT’s K-Bank and BC Card through this investment round.

- Standard Energy, which produces vanadium ion batteries, has raised KRW 10 billion in investment. The company targeting the energy storage system(ESS) sector is expected to create new standards in the global ESS market.

- Brandy, a fashion platform, raised KRW 10 billion in strategic investment from KDB Industrial Bank and plans to expand its fulfillment infrastructure in Dongdaemun (Korea’s largest wholesale and retail shopping district) and explore markets overseas.

- Robo-advisor asset management service Uprise, such as cryptocurrency investment, has secured KRW 9 billion in investment that will use it to popularize the digital asset market.

- MaqVision, which uses AI to monitor counterfeit products, raised KRW 3.6 billion in investment and plans to expand its territory.

#Trend Analysis

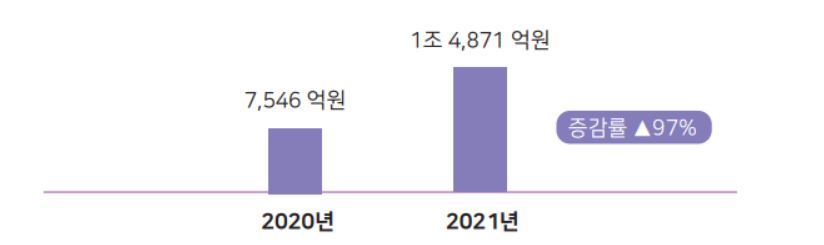

Funding in Korean Startups nearly doubling in the Q1

Startup funding in the first quarter of this year was KRW 1.4871 trillion, a 97 percent increase from the previous year (KRW 754.6 billion). According to an investment report issued by Startup Recipe this March, investment doubled from the first quarter of 2020, when investment performance dropped significantly in the aftermath of covid19. Now the investment has flowed into startups in the first quarter of this year.

Domestic startup investment performance slowly entered a recovery phase from the second half of last year, attracting a total of KRW 563.4 billion in March. There were a total of 83 investments. Following February, investment more than doubled March compared to the same month last year, and more capital is flowing into startups beyond the covid19 recovery.

By sector, large-scale investments were made focusing on services that fit the changed lifestyle invoked by the pandemic, such as online shopping and delivery, remote work, and non-face-to-face education. Examples include the unicorn fashion platform Musinsa, raising KRW 130 billion valued at KRW 2.5 trillion, and the luxury shopping platform Trenbe closing KRW 22 billion in investment. The limited-edition resell platform Kream finalizing KWR 20 billion. Contact-free services, which represent the consumption method of the Millennials and Gen Z, have attracted attention from investors.

In the logistics market, where competition has intensified due to early morning delivery, Team Fresh raised a significant investment of KRW 30 billion. Meanwhile, non-face-to-face online education startups such as Classting and Ringle have raised KRW 10.5 billion and KRW 10 billion, respectively. The blockchain sector, which once caused a boom in 2018, was in the spotlight again thanks to bitcoin prices and cryptocurrency optimism rising from major financial institutions.

Though there were many seed-stage investments, investment concentrated on the top. Companies that attracted more than KRW 10 billion in the Series A-C round accounted for 25% of the total number of investments.

Big corporations also made several strategic investments and mergers and acquisitions. In particular, strategic investments have been made in the biopharmaceutical sector. Simultaneously, Lotte Shopping strategically participates in the acquisition of used goods trading platforms, seeking new opportunities in the online used market. After Coupang successfully listed on the New York Stock Exchange, there is news of Market Curly and Dunamu pushing for listing on the U.S. stock market.

Female-founded startups raising investment was somewhat lower than in January and February. Unlike several companies that attracted more than KRW 10 billion in investment such as Market Curly, Onul-siktak, and Finda in January, seed investment was the main focus in March. Female-founded startups attracted less than 1% of the total amount of investment.

![[StartupRecipe] South Korea’s Startup Investment Landscape 2025: 10 Key Findings](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260208_One-page-briefing_ai_00002-200x140.jpg)

![[StartupRecipe] Physical AI Tops Korean VC Investor Preferences in 2026](https://en.startuprecipe.co.kr/wp-content/uploads/2026/02/260129_Startuprecipe-Investment-Report-_00001-200x140.jpg)

![[StartupRecipe] How Korea’s 10 Early-Stage Investors Performed in 2025](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260120_car-racing-desert_ai_5002305-200x140.jpg)

![[StartupRecipe] 85% of Korean Students Use AI, Few Know AI Startups](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260118_seoul_ai_00305035523-1-200x140.jpg)

![[StartupRecipe] Korea’s scale-ups are ditching Seoul and here’s why](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/260107_deep-tech_ai_00000006-200x140.jpg)

![[StartupRecipe] The Rise of U.S.-Based Korean Startups](https://en.startuprecipe.co.kr/wp-content/uploads/2026/01/251229_Aerial-drone-photography_ai_00001-200x140.jpg)