The Korea Venture Investment Corporation (KVIC), under the Ministry of SMEs and Startups, has established a subsidiary in Singapore to launch a Variable Capital Company (VCC) fund, marking a significant step in Korea’s efforts to globalize its venture capital ecosystem.

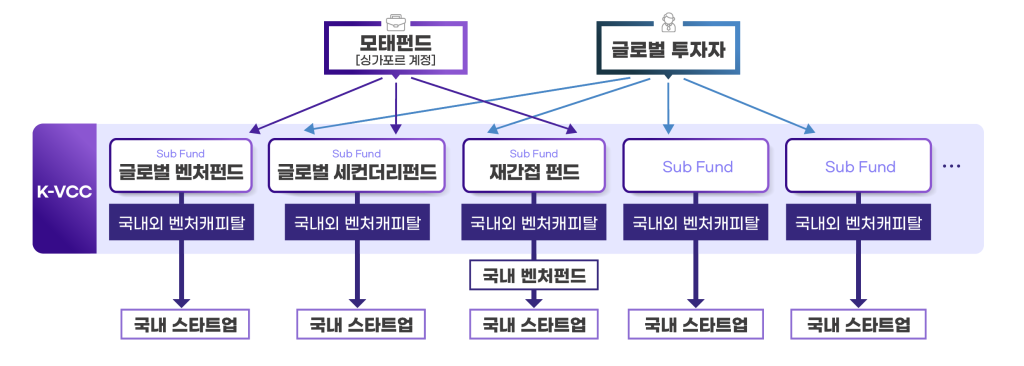

The new entity, provisionally named the K-Global Mother Fund(K-VCC), will serve as the fund manager and aims to create a $200 million fund by 2026. This initiative leverages Singapore’s VCC framework, which allows for the flexible creation and management of multiple sub-funds under a single corporate structure. The VCC regime, introduced by Singapore in 2020, offers advantages such as privacy for shareholders and tax incentives, making it attractive for global investors.

The Singapore subsidiary will act as a regional investment hub, facilitating the attraction of international capital and supporting Korean startups’ expansion into Asia. The fund is designed to bring together domestic venture capital firms and global investors, providing a streamlined pathway for foreign investment into Korean startups.

Previously, KVIC operated only a representative office in Singapore, but the new subsidiary will enable deeper integration with global capital markets and more active fund management. The Ministry of SMEs and Startups has stated that it will move quickly to recruit local staff and secure regulatory approvals, with the goal of establishing the fund by the second quarter of 2026.