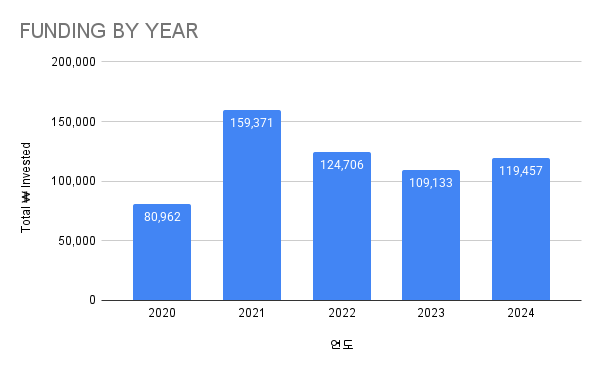

The Korean venture investment market demonstrated a strong recovery in 2024, according to the 2024 Korean Venture Investment report released by the government.

Total venture investment for the year reached 11.9 trillion KRW, marking a 47.5% increase compared to pre-COVID-19 levels (2020) and a 9.5% rise from the previous year. The number of companies securing venture funding hit a record high of 4,697, signaling renewed investor confidence and sustained growth potential.

This marks the first year of rebound after a downward trend that began in 2021, reinforcing a mid- to long-term growth trajectory. The government highlighted that, compared to global markets, Korea’s venture investment landscape showed a clear recovery. While global venture investment fell by 17.1% from 2020 and declined slightly by 0.1% from the previous year, Korea’s market exhibited resilience and expansion.

Key Trends

- Venture capital firms expanded their investments by 22.9% year-on-year, contributing to the market’s upward momentum.

- Investments in early-stage startups (less than three years old) saw a 17% decline, whereas mid-stage startups (3-7 years old) attracted 9.3% more investment. Late-stage startups (7 years or more) experienced a substantial 23.3% increase, indicating a shift in investor preference toward more established companies.

- ICT services led the industry-wide investment surge with a 38% year-on-year increase, followed by electric/machinery/equipment, distribution/services, and bio/healthcare. Conversely, investments in video, performance, and music content suffered the steepest decline, dropping by 23.7%.

- Venture fund formation in 2024 totaled 10.6 trillion KRW, representing a 5.7% increase compared to 2020. This growth is particularly notable given the sharp 52.6% decline in global venture fund formation over the same period.